Interest Rates

Unlock Your Opportunities

we are in a recession: Here’s how to thrive

| Interest Rates, Leads, Real Estate Industry, Real Estate Team

Realtor friends, let’s address the elephant in the room: our industry is in a recession. The US economy may still be growing, but with the jump in interest rates over the past 20 months and tight inventory, we have experienced four consecutive quarters of negative growth (a recession is defined as two consecutive quarters of negative growth). So we're in a recession. In fact, nationally, we are at a ~23% drop in transactions year over ...

Why any interest rate is a good rate for renters

| Interest Rates, Real Estate Buyers, Scripts & Dialogues

Realtor colleagues, we all have friends or acquaintances who are currently renting and should be homeowners. Perhaps they've voiced concerns about buying a home right now, especially given today’s higher interest rates. Perhaps they are concerned about prices relative to where they were just a few years ago. They might be thinking, "I'll wait until the rates drop," or “I’ll wait until the market crashes and prices come down.” But as real estate professionals, ...

Interest Rates: A Crash Course for Realtors

| Finance, Interest Rates, Real Estate Economics

Over the past 5 months, Lockbox has posted primers in the economics that drive our industry. Today’s subject is interest rates: how they are determined and how they impact the residential home sales industry. The Basics: Federal Funds Rate In a previous blog post, you learned about the importance of the Federal Funds Rate. As a refresher, it’s the rate the Federal Reserve sets at which banks can lend money to each other, ...

The Federal Funds Rate: A Crashcourse for Realtors

| Interest Rates, Mortgages, Real Estate Economics, Realtor Level Up

Here’s your reality as a Realtor: your success isn't just determined by taking listings, showing properties, and closing deals. Like it or not, the US economy indirectly influences your leads, sales, and ultimately income. This post is the next post in a series on the economics of the residential real estate market. You are going to learn what the Federal Funds Rate is, what role it plays, how it impacts inflation, and ultimately how ...

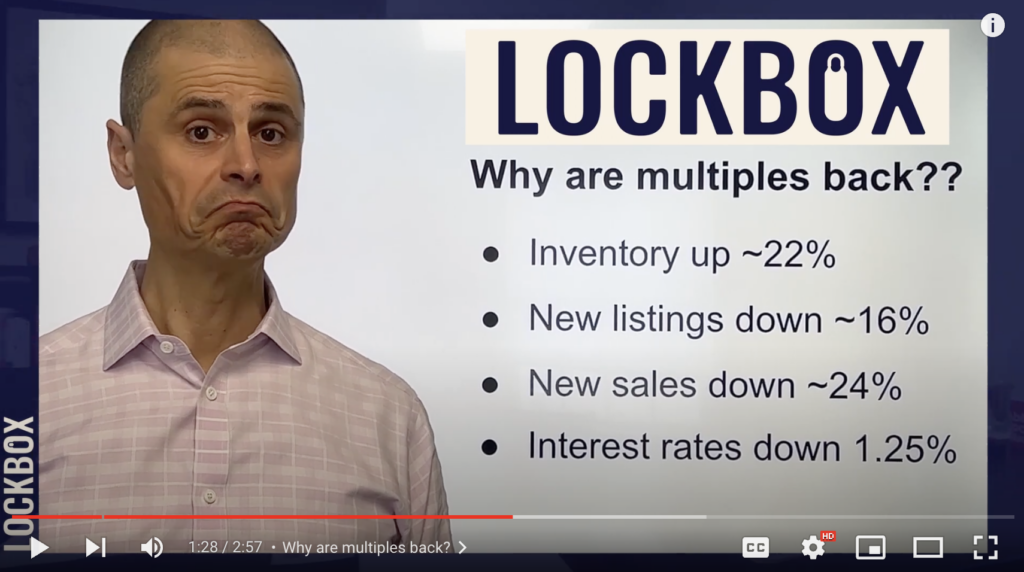

Why Are We Back In Multiples Offers?

| Interest Rates, Mortgages, Real Estate, Real Estate Markets, Realtor Level Up

Why Are We Back In Multiple Offers? Let's Dive Into It. Why are multiples back? What the heck happened? In Q4 of last year, we felt like the real estate market was cooling off. Then, all of a sudden we find ourselves in a multiple-offer situation again. This makes no sense, right? I mean think about it, inventory is up 22%. Multiple offers should happen when there's not enough supply to match demand. If the ...